NavSav Insurance

We Have a Solution For You

Start Navigating Your Savings Today

Calling this number will direct you

to a licensed insurance agent

Welcome to NavSav Insurance

An insurance policy is often the only thing keeping you from financial ruin when the inevitable takes place. As such, your indemnity plan should be something that covers all of your assets. The agents at NavSav Insurance can help you find the insurance policies that fit your lifestyle.

Our agents can help you find the best insurance plan to fit your needs. You may also consider bundling protections into one policy for even more convenience.

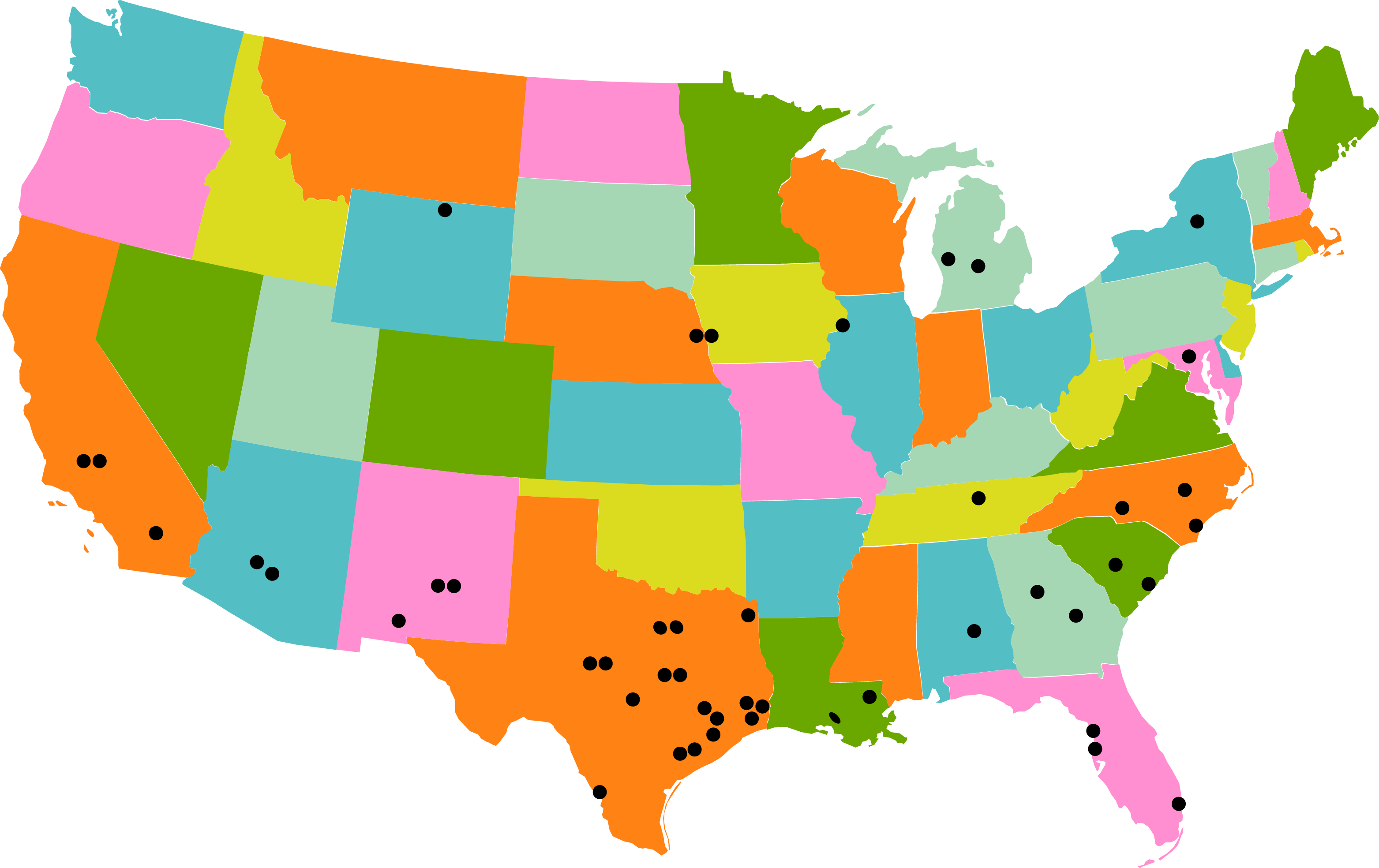

Find An Agency Near Me

Choose from NavSav’s other products Or, get an Instant Quote

Natural Disaster

Renters

Business

Looking for an Agent? Find an insurance agent near me.

More Insurance Options

Commercial / Business Insurance

NavSav Insurance offers you the best in commercial and business insurance solutions. Our experienced agents are here to help you navigate the complex landscape of business insurance with personalized coverage options tailored to your unique needs. We can help you protect your business from property damage, liability claims, cyberattacks, and other unexpected risks that may arise. With comprehensive knowledge of the marketplace and a proven track record for finding the right policy for each customer, NavSav Insurance is here to make sure you have the coverage you need at a price that works for you.

Comprehensive Natural Disaster Coverage

NavSav Insurance provides comprehensive coverage for businesses and individuals. Our knowledgeable agents will help you create a personalized insurance plan tailored to your unique needs, ensuring that you are fully protected from the unpredictable forces of Mother Nature. So, you can rest easy knowing that if your property is damaged due to floods, hurricanes, hail, fire, tornadoes, wildfires or earthquakes, our experienced team is here to provide you with the financial security and peace of mind that you deserve. Whether you're looking for property damage protection, business interruption coverage or both, NavSav Insurance has you covered!

Marine / PWC Insurance

NavSav Insurance offers you the best in commercial and business insurance solutions. Our experienced agents are here to help you navigate the complex landscape of business insurance with personalized coverage options tailored to your unique needs. We can help you protect your business from property damage, liability claims, cyberattacks, and other unexpected risks that may arise. With comprehensive knowledge of the marketplace and a proven track record for finding the right policy for each customer, NavSav Insurance is here to make sure you have the coverage you need at a price that works for you.

Motorcycle / ATV Insurance

NavSav Insurance offers comprehensive and affordable motorcycle and ATV insurance solutions that can be tailored to meet most any budget. Our experienced team of brokers will work hard to provide you with the best coverage for your specific needs, including liability coverage and optional add-ons such as collision, fire, and theft protection. We understand the unique requirements of riders in different types of terrain, so we are well positioned to help you secure the appropriate level of coverage for whatever vehicle you use. We pride ourselves on providing great customer service, so don't hesitate to speak with one of our knowledgeable agents today who can help find the perfect insurance policy for you. With NavSav Insurance, you'll get a customized policy at an unbeatable price!

Our Carriers

We’ll help you customize the perfect policies for your clients. From personal lines to commercial lines, we have the relationships that provide you with the best rates. Say goodbye to product limitations and unhappy customers due to price changes.